Secure Your Family’s Future: Financial Freedom for Diabetics

The High Cost of Diabetes: Why Financial Education Matters

Living with diabetes comes with a significant financial burden. For years, I have been so very worried about covering the costs of healthcare in the future - and filled with anxiety and fear for the health of my family.

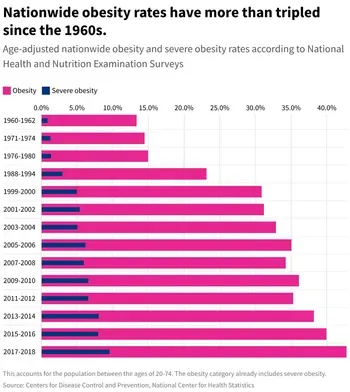

On average, healthcare costs for diabetics are about 2.3 times higher than for those without the condition. This financial strain underscores the critical need for robust financial knowledge and education for you and your child or teen.

The Financial Impact of Diabetes

Let's break down the costs:

Overall Costs: Diabetics face annual medical expenses averaging $16,752, with about $9,601 directly attributed to diabetes care. These costs include doctor visits, medications, and medical supplies.

Medications and Supplies: Regular insulin, glucose monitors, test strips, and other essential supplies can amount to several thousand dollars per year. For instance, insulin alone can range from $50 to $1,000 per month, depending on the type and dosage.

Hospital and Emergency Services: Complications from diabetes, such as heart disease, kidney failure, and neuropathy, often result in more frequent hospitalizations and emergency care, further driving up healthcare costs.

Long-term Complications: Managing long-term complications like cardiovascular diseases, kidney disease, eye complications, and foot problems adds to the overall financial burden. Treatments for these conditions can cost thousands of dollars annually.

Why Financial Education is Essential

Given these high costs, financial education becomes a crucial tool for managing the economic impact of diabetes. Understanding how to manage money, save effectively, and invest wisely can make a significant difference in handling the expenses associated with diabetes care.

The Role of Financial Literacy

Financial literacy involves understanding how to budget, save, invest, and plan for the future. For diabetics, and indeed for everyone, this knowledge is vital. Here’s why:

Budgeting for Healthcare: Knowing how to budget effectively allows you to allocate funds for necessary medications and supplies, ensuring you don't run short when unexpected expenses arise.

Saving for Emergencies: Having a savings cushion can help cover sudden medical expenses, reducing the stress and impact of unplanned costs.

Investing Wisely: Investing can help grow your savings over time, providing a financial buffer for future healthcare needs.

Planning for the Long Term: Long-term financial planning ensures that you can manage ongoing healthcare costs without compromising other life goals.

Taking Action: Financial Education for Families

It's essential to start financial education early to prepare ourselves and our children for financial success. My mentor, Paul O'Mahoney, developed programs like ReThink Social Media and Financial Freedom to teach kids and teens practical advice on how to earn money, manage their finances, make wise investments, and set themselves up for a fulfilling life.

Here’s what you and your kids can learn:

Good Saving, Investing, and Spending Habits: Learning these habits early can help kids manage their money effectively and avoid common financial pitfalls.

Career Advancement Models: Understanding career advancement strategies can guide teens in making informed decisions about their futures.

Real-Life Money-Making Opportunities: Kids can learn how to earn and save money for significant expenses, such as college, reducing future debt.

Establishing Good Money Mindset Habits: Early education in financial literacy helps build a solid foundation for wealth building.

Join the Movement

The founder of Financial Freedom is hosting a presentation on Wednesdays to share these valuable insights. You can check out and register for the webinar here(#). Or, you can also download their book(#) for free (or get a hard copy and just pay shipping).

Conclusion

Managing the financial burden of diabetes requires not just medical intervention but also strong financial literacy. By educating ourselves and our children about financial management, we can better navigate the costs of healthcare and set ourselves up for a more secure future.

Stay healthy and safe in all ways!